---

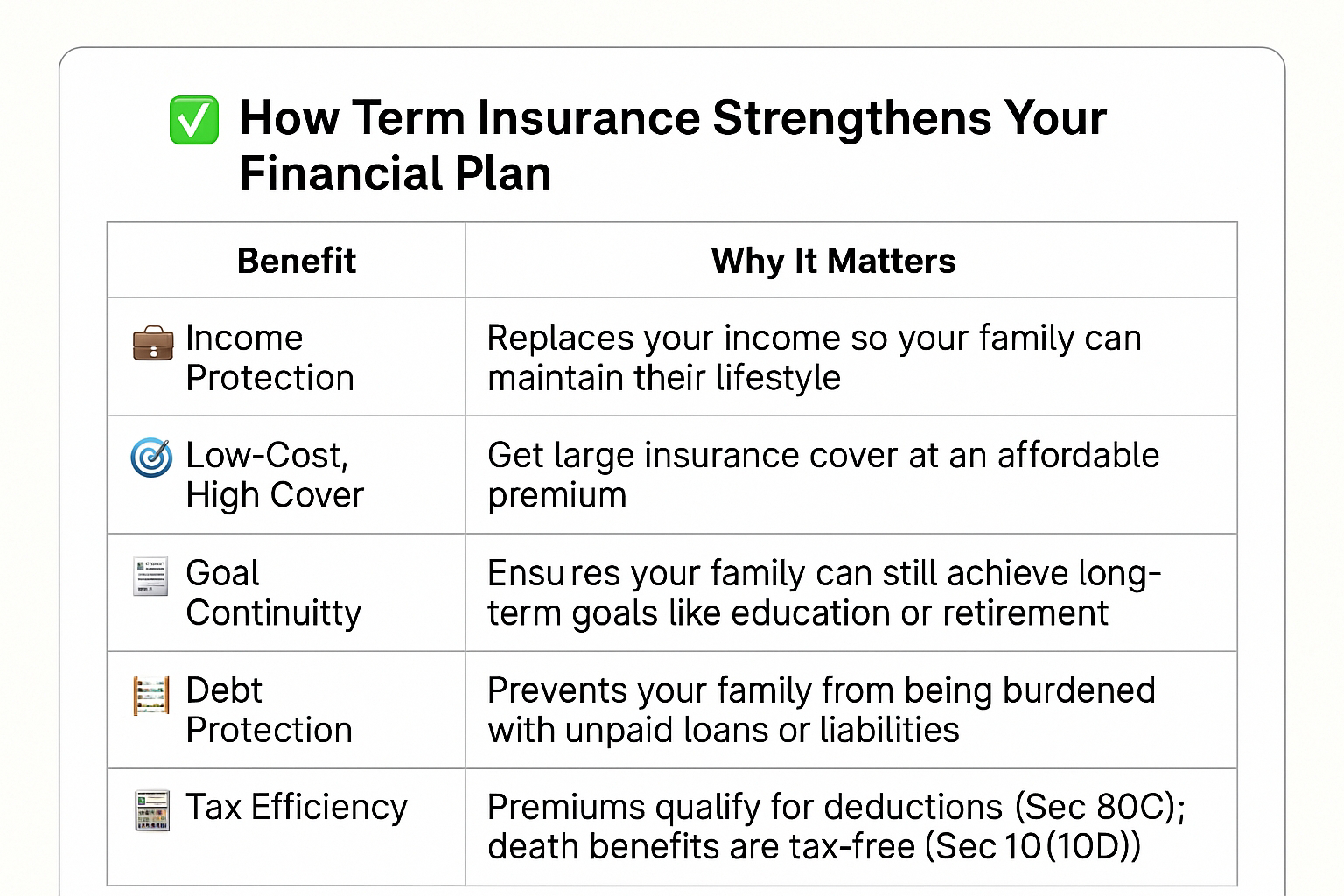

🛡️ 1. Income Protection

If you are the primary earner, your family depends on your income.

Term insurance replaces that income in case of your untimely death.

This ensures your family's lifestyle, education, and daily needs are met even when you're not around.

---

🧾 2. Low-Cost, High Coverage

Term plans offer large cover amounts (like ₹50 lakh to ₹1 crore or more) at affordable premiums.

This allows you to protect your financial goals without burdening your cash flow.

---

🏠 3. Protects Long-Term Financial Goals

It ensures your family can still meet goals like:

Children’s education or marriage

Paying off home loans or debts

Retirement savings for your spouse

---

💼 4. Complements Investment Plans

Investments (like SIPs, MFs, or real estate) help in wealth creation.

Term insurance ensures those plans are not disrupted in your absence.

Think of it as a safety net, not an investment.

---

📉 5. Debt Protection

If you have loans (home, personal, car), term insurance makes sure your family isn’t left with unpaid liabilities.

---

📊 6. Tax Benefits (Under Section 80C & 10(10D))

Premiums paid are eligible for tax deductions under Section 80C.

Death benefits are tax-free under Section 10(10D).

Contact - 7737726236

For Complete Understanding of you financial well-being

No comments:

Post a Comment