Monday, July 21, 2025

⚠️ हेल्थ इंश्योरेंस की छुपी बातें जो कोई नहीं बताता

🛡️ अगर कुछ अनहोनी हो जाए तो टर्म इंश्योरेंस कैसे आपके परिवार की मदद करता है

Things to keep in mind before taking health Insurance

✅ 10 Smart Checks Before Buying Health Insurance:

-

🏥 What’s Covered?

Hospital bills, surgeries, daycare treatments? -

⏳ Waiting Time

Pre-existing diseases often need a 2–4 year wait. -

🛏️ Room Rent Limit

Choose your hospital room freely? Check for caps. -

💸 Co-Pay Clause

Will you pay a % of the bill? -

🏨 Cashless Hospitals

Your favorite hospital on their list? -

🩺 Sub-Limits

Any caps on doctor fees or treatment costs? -

🎁 No Claim Bonus

More coverage if you don’t claim—worth checking! -

🔄 Lifetime Renewal

Can you renew the policy forever? -

⚖️ Value for Money

Cheapest isn’t always best. Look for balance. -

❌ Know What’s Not Covered

Exclusions matter—read the fine print!

Why Medical Insurance is Absolutely Necessary – A Deep Dive

Medical Insurance in a nutshell

🛡️ Why You Should Buy Term Insurance Through an Advisor – Not Just Online

Sunday, July 20, 2025

🛡️ टर्म इंश्योरेंस: आपकी वित्तीय योजना का एक ज़रूरी हिस्सा

🛡️ टर्म इंश्योरेंस: आपकी वित्तीय योजना का एक ज़रूरी हिस्सा

टर्म इंश्योरेंस आपके परिवार की आर्थिक सुरक्षा और जोखिम प्रबंधन में मदद करता है। यह अनपेक्षित परिस्थितियों, जैसे आपकी असमय मृत्यु, में आपके परिवार की आर्थिक मदद करता है।

💼 1. आय की सुरक्षा (Income Protection)

- अगर आप परिवार के कमाने वाले सदस्य हैं, तो आपकी आमदनी पर पूरा परिवार निर्भर करता है।

- टर्म इंश्योरेंस आपकी मृत्यु की स्थिति में उस आमदनी को रिप्लेस करता है।

- इससे आपके परिवार का रहन-सहन, बच्चों की पढ़ाई और रोज़मर्रा की ज़रूरतें पूरी होती रहती हैं।

💸 2. कम प्रीमियम में ज़्यादा सुरक्षा (Low-Cost, High Coverage)

- टर्म प्लान बहुत ही कम प्रीमियम में उच्च बीमा राशि प्रदान करते हैं (जैसे ₹50 लाख से ₹1 करोड़ या उससे अधिक)।

- इससे आप बिना ज़्यादा खर्च किए अपने परिवार को आर्थिक रूप से सुरक्षित कर सकते हैं।

🎯 3. लंबी अवधि के लक्ष्यों की सुरक्षा (Protects Long-Term Goals)

- आपकी अनुपस्थिति में भी यह सुनिश्चित करता है कि परिवार के लक्ष्य पूरे हो सकें, जैसे:

- बच्चों की शिक्षा या शादी

- होम लोन की अदायगी

- जीवनसाथी का रिटायरमेंट

🧾 4. ऋण सुरक्षा (Debt Protection)

- अगर आपके ऊपर कोई लोन है (जैसे होम लोन, पर्सनल लोन), तो टर्म इंश्योरेंस यह सुनिश्चित करता है कि आपके परिवार को वह बोझ न उठाना पड़े।

🧮 5. कर लाभ (Tax Benefits - धारा 80C और 10(10D))

- टर्म इंश्योरेंस के लिए दिए गए प्रीमियम पर आपको धारा 80C के तहत टैक्स में छूट मिलती है।

- मृत्यु लाभ पर मिलने वाली राशि धारा 10(10D) के अंतर्गत पूरी तरह टैक्स फ्री होती है।

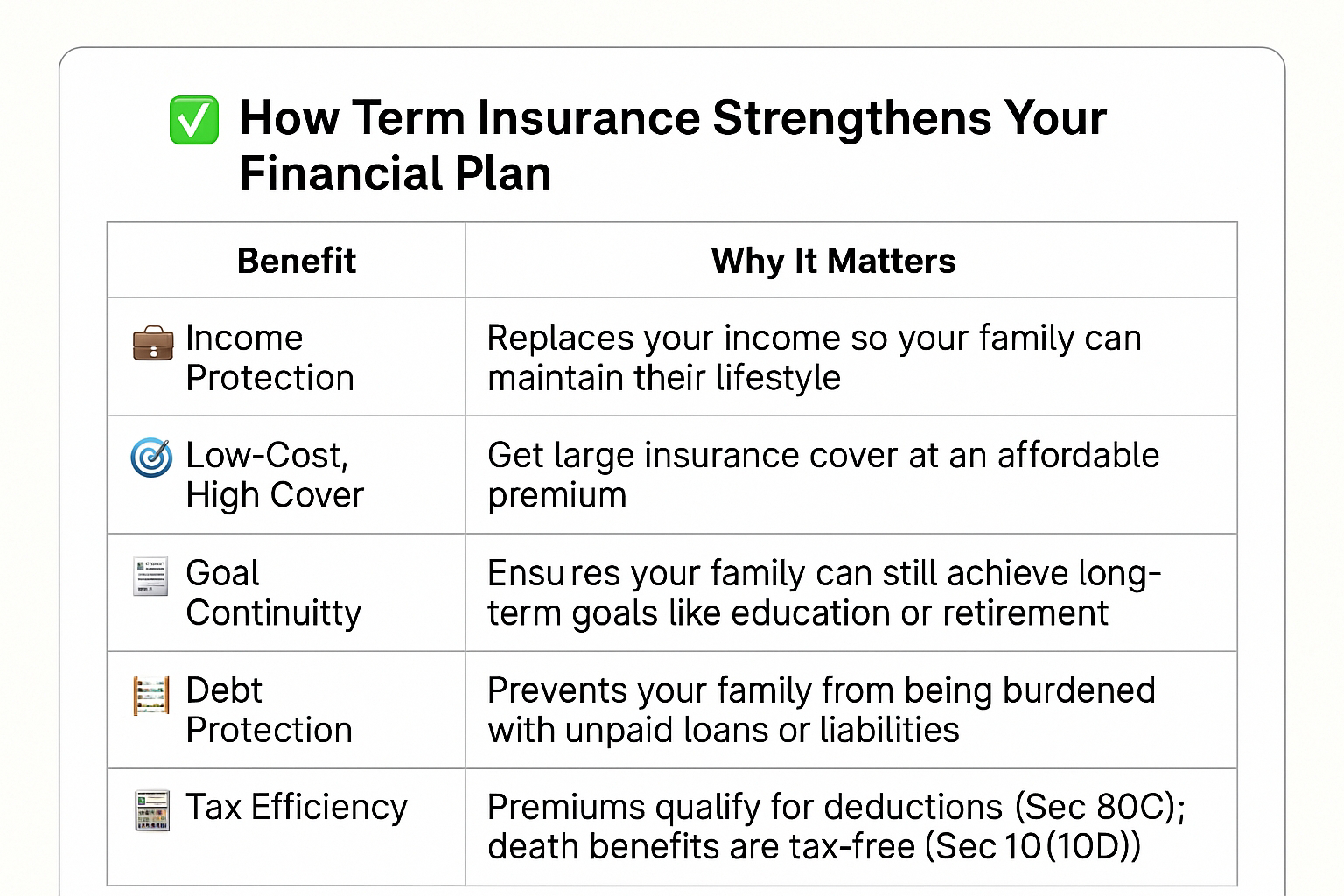

📊 सारांश: क्यों टर्म इंश्योरेंस ज़रूरी है?

| लाभ | विवरण |

|---|---|

| ✅ आय की सुरक्षा | परिवार की आमदनी सुनिश्चित करता है |

| ✅ कम प्रीमियम, अधिक सुरक्षा | कम खर्च में ज़्यादा बीमा |

| ✅ लक्ष्य पूरे होते रहें | परिवार के सपने रुकें नहीं |

| ✅ कर्ज से मुक्ति | लोन का बोझ परिवार पर न पड़े |

| ✅ टैक्स बचत | प्रीमियम पर छूट और क्लेम पर टैक्स नहीं |

Term Insurance Is the Part of Financial well -being , Do Not Ignore It !

Saturday, July 19, 2025

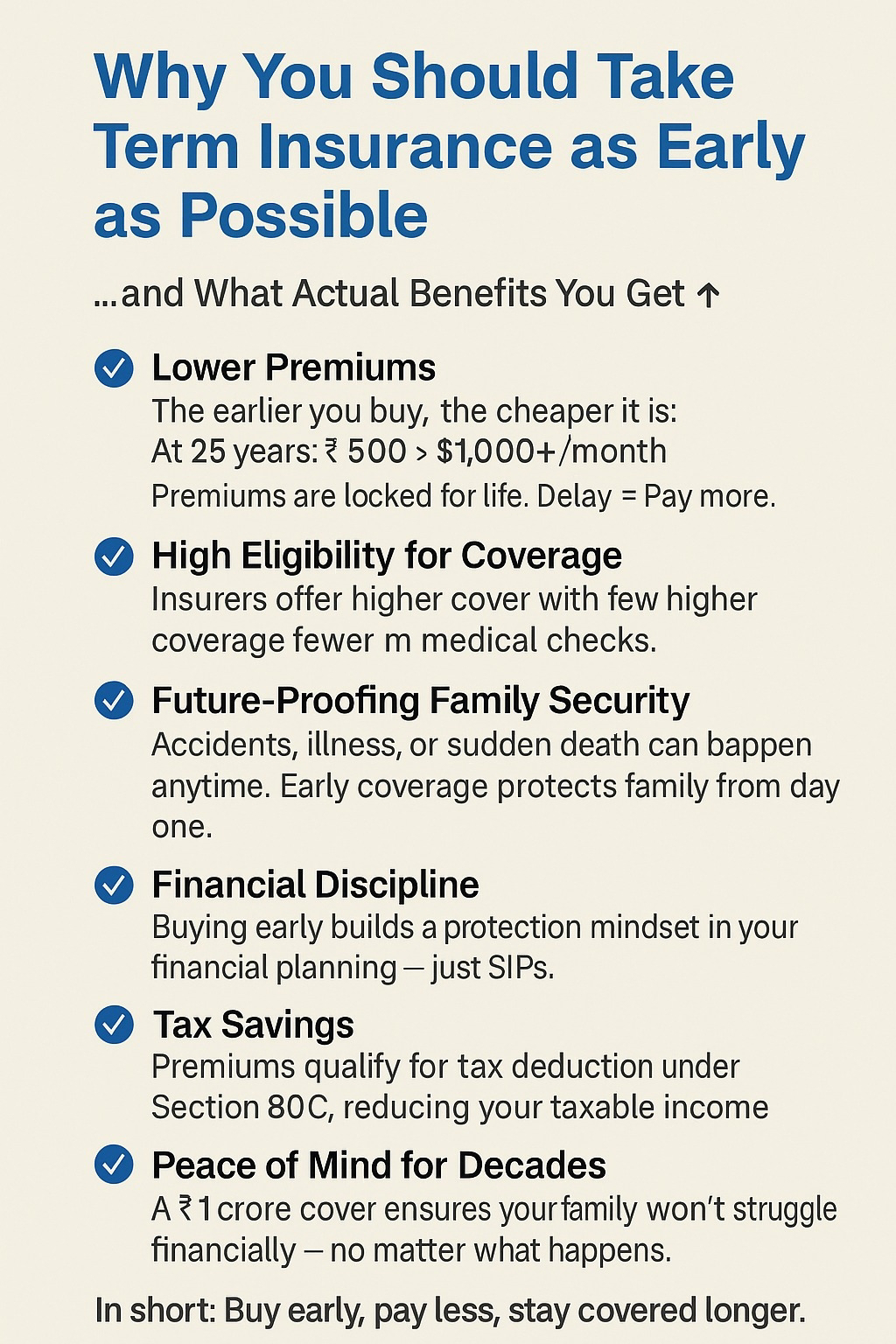

Why You Should Take Term Insurance as Early as Possible

🕒 Why You Should Take Term Insurance as Early as Possible

...and What Actual Benefits You Get 👇

✅ 1. Lower Premiums

The earlier you buy, the cheaper it is.

At 25 years: ₹500/month

At 35 years: ₹1,000+/month

Premiums are locked for life. Delay = Pay more.

✅ 2. High Eligibility for Coverage

When you’re young and healthy, insurers offer higher cover with fewer medical checks.

✅ 3. Future-Proofing Family Security

Accidents, illness, or sudden death can happen anytime. Early coverage protects your family from day one.

✅ 4. Financial Discipline

Buying early builds a protection mindset in your financial planning — just like SIPs.

✅ 5. Tax Savings

Premiums qualify for tax deduction under Section 80C, reducing your taxable income.

✅ 6. Peace of Mind for Decades

A ₹1 crore cover ensures your family won’t struggle financially — no matter what happens.

✅ 7. No Dependence on Employer Insurance

Job changes can cancel employer insurance. Term plan = your permanent safety net.

In short:

📌 Buy early, pay less, stay covered longer.

That’s how you get the most value from term insurance.

for more information Contact - 7737726236

Why term insurance is the only life insurance, you should take!

🛡️ Why Term Insurance is the Only Real Life Insurance

When people hear "life insurance," they often think of fancy policies with returns, bonuses, and maturity benefits. But the truth is — most life insurance products are just expensive savings plans with poor returns.

Here’s why Term Insurance is the only pure form of life insurance that actually protects your family:

🔍 1. Purpose: Protection vs Investment

| Feature | Term Insurance | Traditional Life Insurance (e.g., Endowment, ULIP) |

|---|---|---|

| Core Purpose | Financial protection for family | Mix of protection + returns |

| Coverage Amount (Sum Assured) | ₹1 Cr+ (affordable) | ₹5–10 Lakhs (very limited) |

| Returns | None (pure protection) | 4%–6% (low post-tax returns) |

✅ Term Insurance: Pure risk cover — high sum assured at low premium

❌ Others: Low coverage, disguised as savings with average returns

💸 2. Cost Comparison

-

₹1 Crore Term Plan at Age 30: ~₹10,000/year

-

₹10 Lakh Endowment Plan: ₹50,000–70,000/year

Which one gives better protection for your family?

Clearly, Term Insurance wins — 10x more coverage at 1/5th the cost.

🧠 3. Flexibility & Simplicity

-

Term plans are easy to understand – you pay for coverage, that's it.

-

You can use the money saved to invest in mutual funds, SIPs, or PPF for better returns.

💡 Instead of mixing insurance with investment, keep them separate:

🛡️ Term Plan = Protection

📈 Mutual Fund = Wealth Creation

⚠️ 4. What People Often Miss

Many people buy traditional life insurance thinking it’s an investment.

But the harsh truth is:

👉 You’re neither getting good insurance nor good returns.

✅ Final Verdict: Buy Term. Invest the Rest.

-

Protect your loved ones with high-cover term insurance

-

Invest smartly in SIPs or mutual funds for long-term wealth

-

Don’t fall for low-return, bundled insurance traps

How much money do I need for retirement at the age 55 my current expenses are 50k per month current age 30

To retire at age 55 with ₹50,000 monthly expenses today and you're currently 30 , you need to account for inflation , retirement durat...

-

📈 भारत में म्यूचुअल फंड में जोखिम लेना क्यों ज़रूरी है? “जोखिम तब आता है जब आपको नहीं पता कि आप क्या कर रहे हैं।” – वॉरेन बफे भारत म...

-

💡 Enhanced SIP: The Smart Way to Build Long-Term Wealth When it comes to wealth creation, consistency matters more than intensity. One o...

-

Open a Trading & Investing account with any of Broker In F&O charges are 20Rs per Order And In Delivery Cash Zero Brokerage Here...