Sunday, July 20, 2025

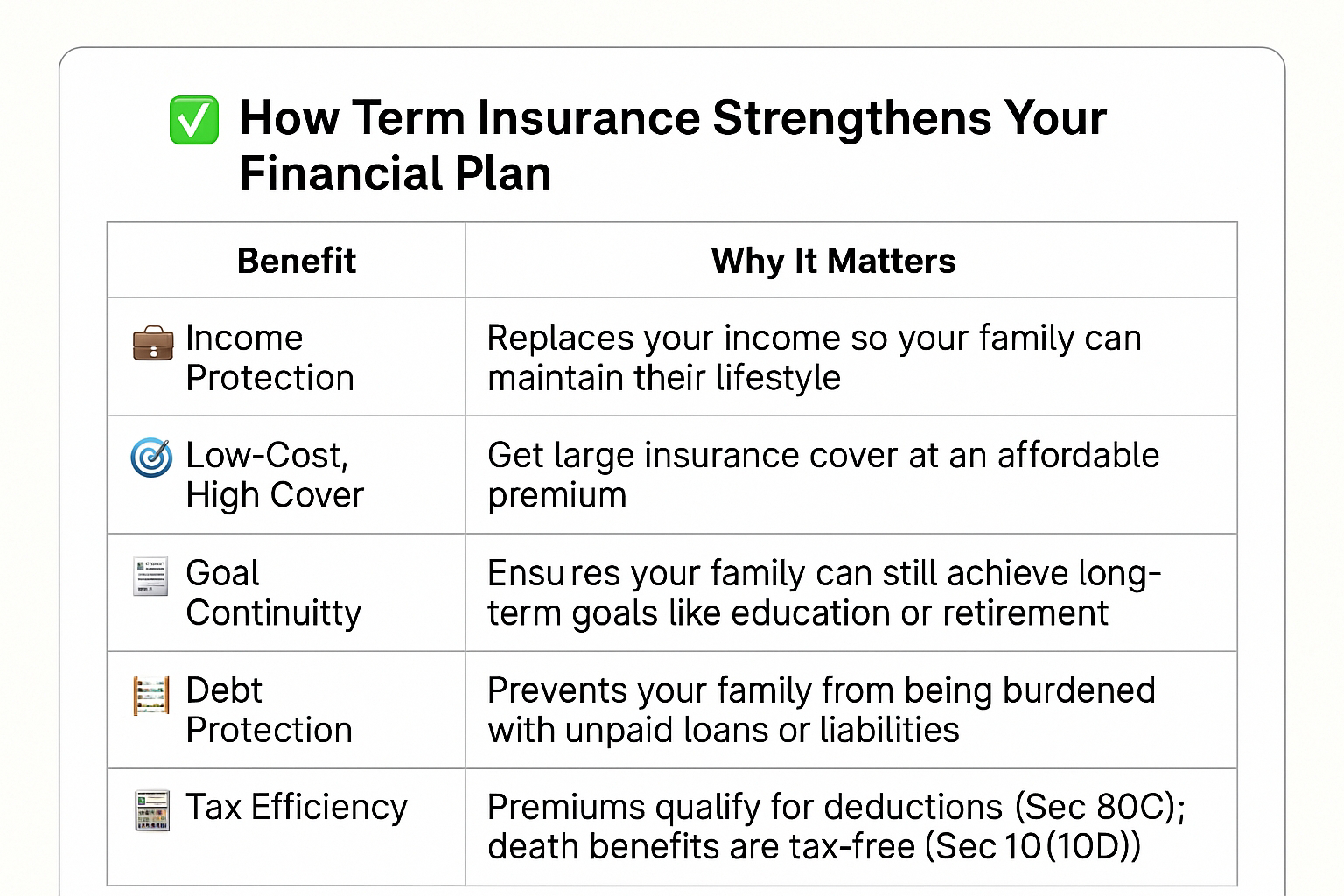

Term Insurance Is the Part of Financial well -being , Do Not Ignore It !

Saturday, July 19, 2025

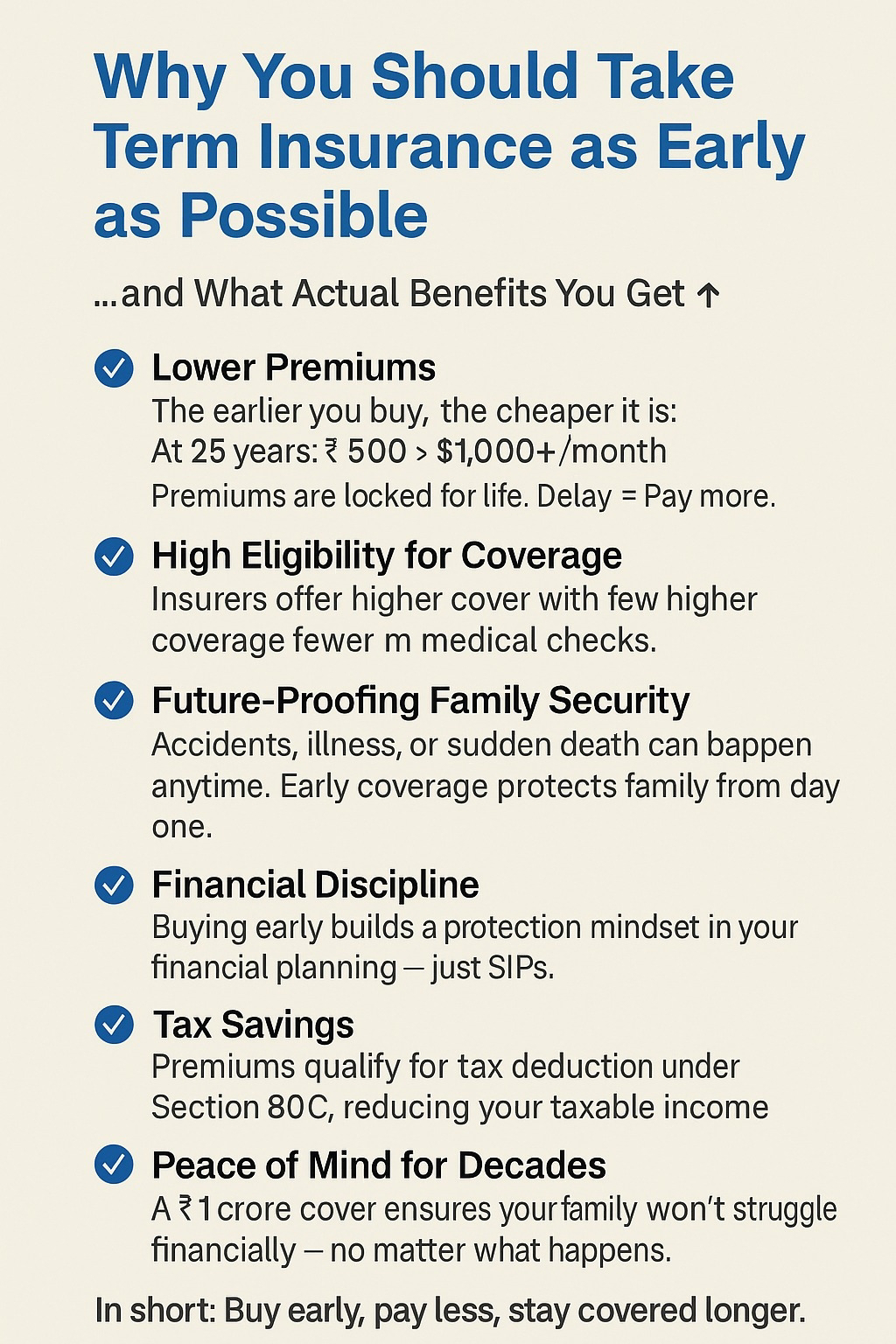

Why You Should Take Term Insurance as Early as Possible

🕒 Why You Should Take Term Insurance as Early as Possible

...and What Actual Benefits You Get 👇

✅ 1. Lower Premiums

The earlier you buy, the cheaper it is.

At 25 years: ₹500/month

At 35 years: ₹1,000+/month

Premiums are locked for life. Delay = Pay more.

✅ 2. High Eligibility for Coverage

When you’re young and healthy, insurers offer higher cover with fewer medical checks.

✅ 3. Future-Proofing Family Security

Accidents, illness, or sudden death can happen anytime. Early coverage protects your family from day one.

✅ 4. Financial Discipline

Buying early builds a protection mindset in your financial planning — just like SIPs.

✅ 5. Tax Savings

Premiums qualify for tax deduction under Section 80C, reducing your taxable income.

✅ 6. Peace of Mind for Decades

A ₹1 crore cover ensures your family won’t struggle financially — no matter what happens.

✅ 7. No Dependence on Employer Insurance

Job changes can cancel employer insurance. Term plan = your permanent safety net.

In short:

📌 Buy early, pay less, stay covered longer.

That’s how you get the most value from term insurance.

for more information Contact - 7737726236

Why term insurance is the only life insurance, you should take!

🛡️ Why Term Insurance is the Only Real Life Insurance

When people hear "life insurance," they often think of fancy policies with returns, bonuses, and maturity benefits. But the truth is — most life insurance products are just expensive savings plans with poor returns.

Here’s why Term Insurance is the only pure form of life insurance that actually protects your family:

🔍 1. Purpose: Protection vs Investment

| Feature | Term Insurance | Traditional Life Insurance (e.g., Endowment, ULIP) |

|---|---|---|

| Core Purpose | Financial protection for family | Mix of protection + returns |

| Coverage Amount (Sum Assured) | ₹1 Cr+ (affordable) | ₹5–10 Lakhs (very limited) |

| Returns | None (pure protection) | 4%–6% (low post-tax returns) |

✅ Term Insurance: Pure risk cover — high sum assured at low premium

❌ Others: Low coverage, disguised as savings with average returns

💸 2. Cost Comparison

-

₹1 Crore Term Plan at Age 30: ~₹10,000/year

-

₹10 Lakh Endowment Plan: ₹50,000–70,000/year

Which one gives better protection for your family?

Clearly, Term Insurance wins — 10x more coverage at 1/5th the cost.

🧠 3. Flexibility & Simplicity

-

Term plans are easy to understand – you pay for coverage, that's it.

-

You can use the money saved to invest in mutual funds, SIPs, or PPF for better returns.

💡 Instead of mixing insurance with investment, keep them separate:

🛡️ Term Plan = Protection

📈 Mutual Fund = Wealth Creation

⚠️ 4. What People Often Miss

Many people buy traditional life insurance thinking it’s an investment.

But the harsh truth is:

👉 You’re neither getting good insurance nor good returns.

✅ Final Verdict: Buy Term. Invest the Rest.

-

Protect your loved ones with high-cover term insurance

-

Invest smartly in SIPs or mutual funds for long-term wealth

-

Don’t fall for low-return, bundled insurance traps

Sunday, July 13, 2025

How Sips Helps To Make Long term Wealth

Wednesday, July 9, 2025

💸 Invest ₹1 Lakh Monthly for 15 Years… and Retire with ₹27+ Crores!

💸 Invest ₹1 Lakh Monthly for 15 Years… and Retire with ₹27+ Crores!

With a consistent SIP strategy, you can build a lifelong pension plan — powered by equity mutual funds.

Here’s a powerful example:

👤 Investor Age: 35 years

📥 Monthly SIP: ₹1,00,000

📆 Investment Period: 15 Years

📤 Withdrawal Start Age: 50

📆 Withdrawal Period: 35 Years (Till Age 85)

🔁 Retirement Income Plan:

💵 First Year Monthly SWP: ₹2,03,500

📈 Annual Increase in SWP: 6%

💰 Total Lifetime Withdrawal: ₹27.95 Crores+

📊 All this from just ₹1L SIP for 15 years.

That’s the power of equities and compounding.

🔑 Equities can set you free for life.

Start early. Stay consistent. Let time do the magic.

✅ Our Ultimate Goal

To help you put your money to work, so you can enjoy a stress-free, financially secure life for decades to come.

📞 Let’s Talk!

👉 Contact: 7737726236

🔗 Open & Get Started: open

💬 Book a Call Now: open

Let’s build your financial future — together. Your dreams, our mission.

🌱 Start Today — It’s never too early, and never too late.

Tuesday, July 8, 2025

How Mutual Funds and EMIs Can Help You Clear Loans Faster ?

🏡💰 How Mutual Funds and EMIs Can Help You Clear Loans Faster

In today’s world, almost everyone has some kind of loan — a home loan, car loan, or personal loan.

We all pay EMIs (monthly payments), but what if you could become debt-free faster?

By using a smart mix of mutual fund investments and EMI planning, you can reduce your loan burden and save on interest.

Let’s break it down 👇

✅ 1. Understand How EMIs Work

Your EMI has two parts:

Principal (the actual loan amount)

Interest (extra money paid to the bank)

In the beginning, you mostly pay interest, not the principal.

This means it takes a long time to reduce the loan. But you can speed it up!

✅ 2. Save Some Extra Money Each Month

Try to save at least 10–20% of your monthly income.

Cut down on unnecessary spending — eating out, shopping, etc.

This saved money is your weapon to attack the loan.

✅ 3. Start a Mutual Fund SIP

Instead of putting all your extra money into the loan, start a SIP (Systematic Investment Plan) in mutual funds.

Why?

Because mutual funds can give better returns than your savings account. Over time, your money grows.

Example:

Invest ₹10,000/month in a mutual fund for 3 years.

You could have around ₹4 lakh (with approx. 7% returns).

Use this amount to part-pay your loan — this will reduce your interest and shorten your loan period.

✅ 4. Use Mutual Fund Returns to Part-Pay Loan

Every year or two:

Check how much your mutual fund has grown.

Withdraw some of it and use it to reduce your loan.

Even a ₹1 lakh part-payment can reduce your EMI term by months or even years!

✅ 5. When Should You Invest vs Prepay?

A simple rule:

If Mutual Fund Returns > Loan Interest (like 6–8%) 👉 Keep investing

If Loan Interest is High (like 12–18%) 👉 Prepay the loan first

High-interest loans (like credit cards or personal loans) should be cleared ASAP.

💡 Bonus Tips:

Use your annual bonus or extra income to either invest more or part-pay the loan.

Don’t take new loans unless needed.

🎯 Final Thoughts:

You don’t have to choose just one path.

Do both:

✔️ Pay your EMIs on time

✔️ Invest through mutual funds

✔️ Use the growth to prepay loans smartly

This way, you can be debt-free faster AND build wealth at the same time

Monday, July 7, 2025

Monday thoughts

Raksha Bandhan 2025 – A Gift of Financial Freedom for Your Sister

Raksha Bandhan 2025 – A Gift of Financial Freedom for Your Sister By Equity Research Institute Raksha Bandhan has always been a celebrat...

-

📈 भारत में म्यूचुअल फंड में जोखिम लेना क्यों ज़रूरी है? “जोखिम तब आता है जब आपको नहीं पता कि आप क्या कर रहे हैं।” – वॉरेन बफे भारत म...

-

💡 Enhanced SIP: The Smart Way to Build Long-Term Wealth When it comes to wealth creation, consistency matters more than intensity. One o...

-

🌟 Your One-Stop Financial Growth Partner Powered by Expertise. Backed by Research. Built for Your Goals. When you start investing with ...